How can you forecast expenses in a way that people feel accountable? How do you explain the past reliably, so that departures from BAU carry an appropriate label?

By enabling data collaboration across your finance function.

- This post is for those who find themselves neck-deep in spreadsheets during plan time.

- This post is for those at the top of a large organisation who need a week or two to provide a robust answer to questions like: 1) Are next year’s figures realistic? 2) Why this over/underspend in the last two quarters?

Plan

Most large organisations will have their Plan suitably managed in the Core Finance System (CFS).

The Plan for next year will typically be the product of this year’s “planning season”, a time when herds of spreadsheets from departmental financial operatives are brought together into one big file that gets loaded into the CFS.

A small version of this annual odyssey is repeated during the necessary periodic updates.

Actuals

In a well-oiled CFS, Actuals are the easy bit – because they are unarguably real.

Forecasts

Forecasts are the moving parts of the “planning odysseys”. They require the involvement of many Finance Managers preparing bottom-up expense programs for approval. All too often, by the time the “big file” is loaded into the CFS, the situation on the ground has shifted.

In normal times, the differences between the Plan and the current reality may be negligible for some but, for many others, it’s substantial.

In Q1 this year, most companies will have needed to go back to the drawing board.

Roll with it

In these circumstances, those who have a “rolling approach” in their planning will just roll with it, dynamically changing forecasts and feeding back to the plan as quickly as things evolve before them.

Those who don’t… they feel the pain.

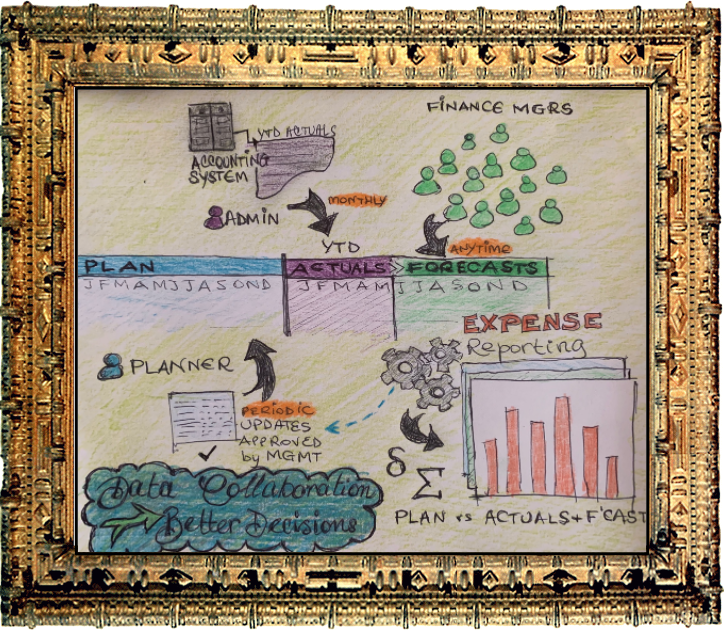

Reliable rolling forecasts come from finance managers able to focus on their part of the canvas and using tools that can paint the big picture in real time.

A bit like this:

Good Tools

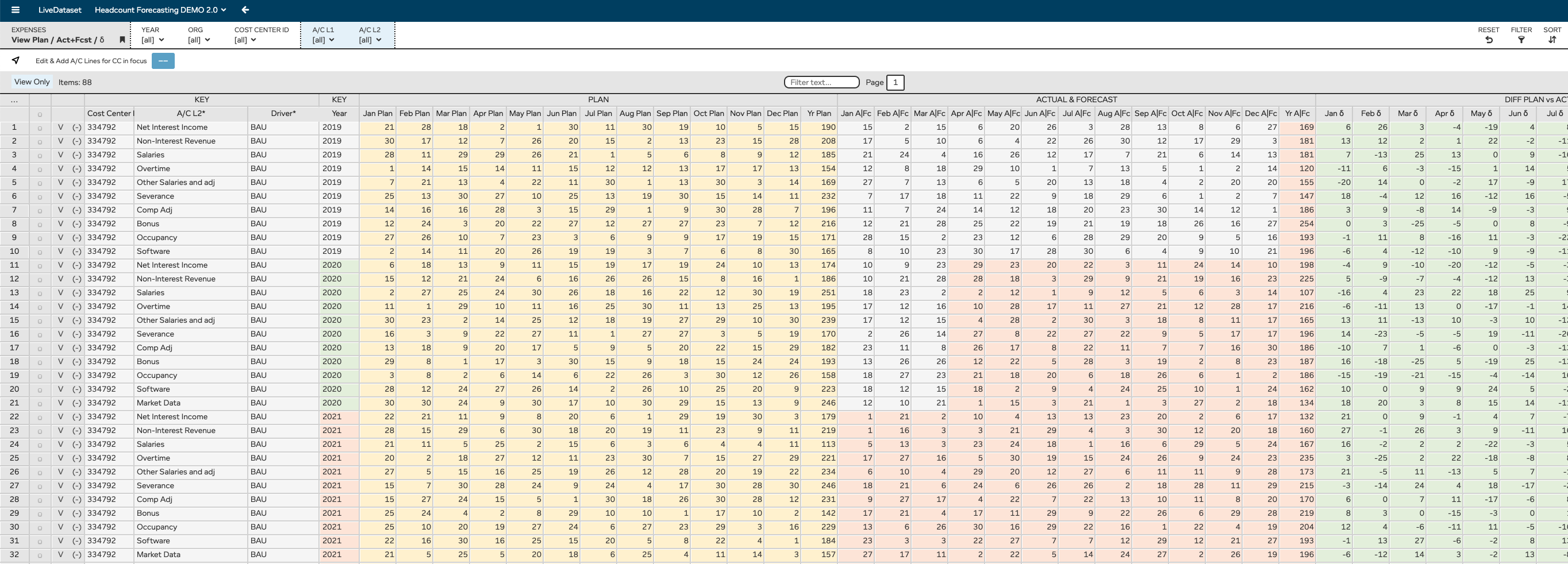

This is what we strive to do with LiveDataset: enable data collaboration for better business decisions.

Our Expense Management solution leverages the data from your existing CFS to share the last 12 to 24 months (or more) with all.

Given this foundation, each divisional finance manager can re-forecast, transparently, the future – anytime and in real time.

With regular re-forecasting, next year’s plan emerges organically from routine reviews.

…Now, what about my two initial questions?

LiveDataset: robust answers

1) “Are next year’s figures realistic?” – Yes with LiveDataset, because: a) they are grounded on a past visible to all at the same level of detail as the forecast; b) they are made available in real-time from the people closest to the business, bringing transparency and accountability; c) they are automatically reconciled against the plan (which itself might – separately – evolve, subject to central controls).

2) “Why this over/underspend in the last two quarters?” – A few paragraphs above I mentioned how Actuals, with a well-oiled CFS, were “easy”. Well, in the CFS they are also set in stone, non-editable logs of reconciled financial activity. LiveDataset, however, allows you to augment the CFS data by enabling the break-down of actuals into specific investment/reduction categories. Better understanding of the past = better forecasting = better decision-making.

Call to action

Are you in planning pain because of the wrong tools? Send us your brief today.